- 1. If I accidentally over-contribute to my 401k, what happens?

- 2. Can I withdraw my excess 401k contributions?

- 3. What happens if I don’t withdraw my excess 401k contributions?

- 4. How can I prevent over-contributing to my 401k?

- 5. Can I fix an excess 401k contribution?

- 6. What if my employer matches my excess contribution?

- 7. Can I carry over excess 401k contributions to the next year?

- 8. How does the IRS detect excess 401k contributions?

- 9. What if I realize I over-contributed after taking a tax deduction?

- 10. Can I over-contribute to my 401k by mistake if I have multiple employers?

- 11. What other retirement accounts can I contribute to if I’ve already maxed out my 401k?

- 12. Should I consult a financial advisor if I over-contribute to my 401k?

What if I over-contribute to my 401k?

Saving for retirement is an essential financial goal, and contributing to a 401k plan is a common way to achieve it. However, sometimes individuals unintentionally contribute too much to their 401k accounts. While saving more for retirement might initially seem like a good thing, over-contributing to your 401k can have consequences. Let’s explore what happens if you over-contribute to your 401k and some important considerations to keep in mind.

When you contribute to a 401k, there are annual limits set by the Internal Revenue Service (IRS) on how much you can contribute. For 2022, the maximum contribution limit is $20,500 for individuals under 50 years old, and $27,000 for those who are 50 or older, subject to certain conditions. If you contribute beyond these limits, your over-contribution can lead to tax complications.

1. If I accidentally over-contribute to my 401k, what happens?

If you over-contribute to your 401k, the excess amount becomes ineligible for preferential tax treatment and is considered a non-qualified distribution.

2. Can I withdraw my excess 401k contributions?

Yes, you have the option to withdraw the excess contribution before the tax deadline, including any earnings it may have generated. However, you will likely have to pay income tax on the withdrawn amount and potentially an additional 10% early withdrawal penalty if you’re under 59.5 years old.

3. What happens if I don’t withdraw my excess 401k contributions?

If you don’t withdraw the excess contributions, you may be subject to double taxation. The excess amount will be taxed when contributed and again when withdrawn.

4. How can I prevent over-contributing to my 401k?

To prevent over-contributing, closely monitor your contributions throughout the year. Keep in mind that different employers have various contribution systems, so it’s important to be aware of your employer’s policies.

5. Can I fix an excess 401k contribution?

Yes, you can fix an excess contribution by requesting a corrective distribution from your employer, returning the excess amount and any earnings it may have generated.

6. What if my employer matches my excess contribution?

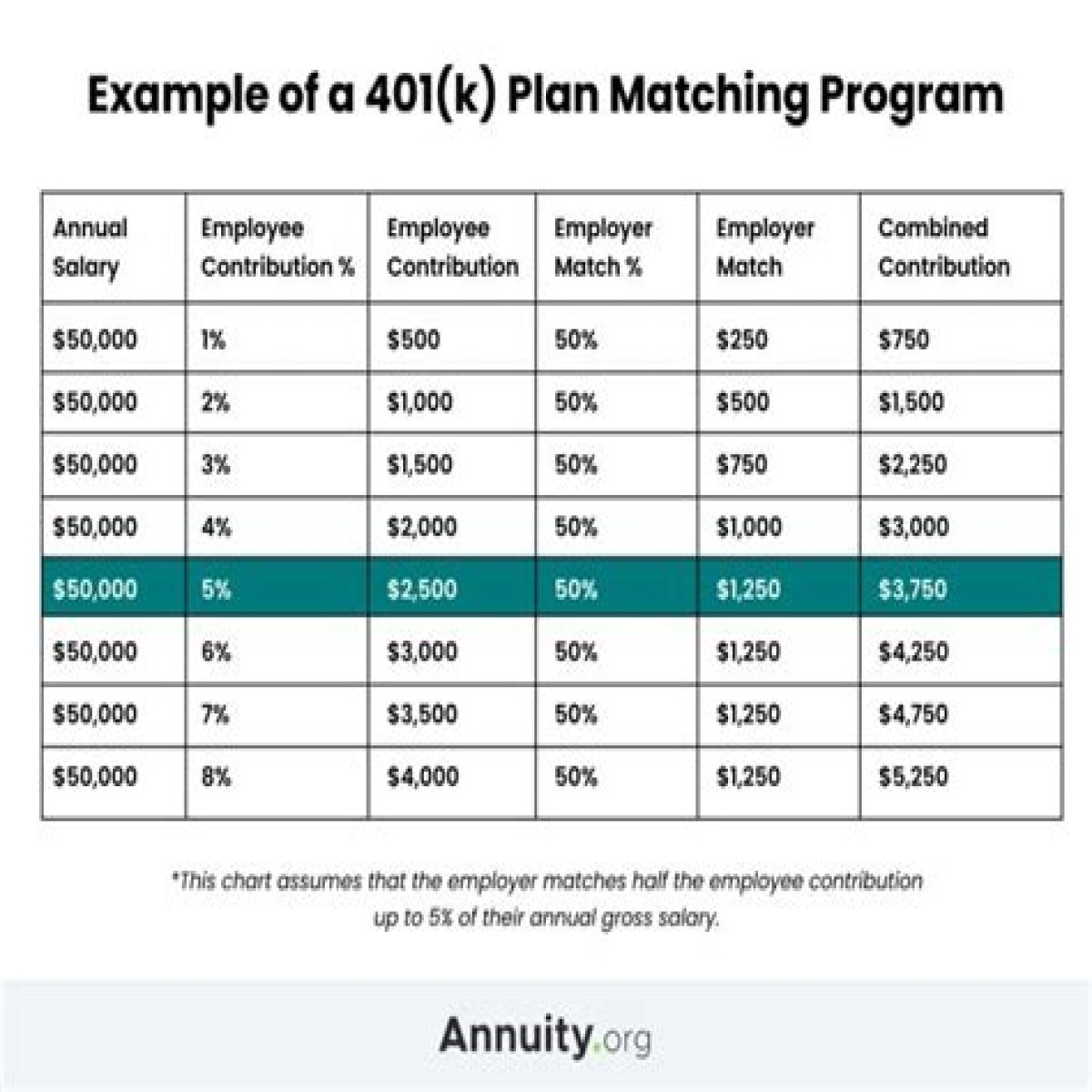

If your employer matches the excess contribution, they may treat it as a regular contribution or as an excess contribution subject to the same rules. Check with your employer or plan administrator for specific guidance.

7. Can I carry over excess 401k contributions to the next year?

No, you can’t carry over excess 401k contributions to the following tax year. The contribution limits reset each year, and any excess must be corrected in the current tax year.

8. How does the IRS detect excess 401k contributions?

The IRS closely monitors 401k contributions through the annual Form 5500 reports filed by employers. They cross-reference these reports with individuals’ tax returns to identify any excess contributions.

9. What if I realize I over-contributed after taking a tax deduction?

If you over-contributed and already took a tax deduction, you must amend your tax return to remove the excess deduction.

10. Can I over-contribute to my 401k by mistake if I have multiple employers?

Yes, if you have multiple employers and contribute to 401k plans with each of them, you must ensure that your total contributions from all employers don’t exceed the annual limit.

11. What other retirement accounts can I contribute to if I’ve already maxed out my 401k?

If you’ve reached the maximum contribution limit for your 401k, you can explore other retirement savings options such as IRAs (Traditional or Roth) or taxable brokerage accounts to continue saving for retirement.

12. Should I consult a financial advisor if I over-contribute to my 401k?

If you’re confused about the implications of over-contributing to your 401k or need personalized advice, it’s wise to consult a financial advisor who can guide you through the process and help ensure you make the necessary corrections.

In conclusion, over-contributing to your 401k can lead to tax complications, but there are steps you can take to rectify the situation. It’s crucial to be aware of the contribution limits, stay vigilant over your contributions, and correct any excess contributions as soon as possible to avoid potential double taxation. Regularly reviewing your retirement savings strategy and seeking professional advice when needed will help you navigate the complexities of retirement planning effectively.